Velocity Banking

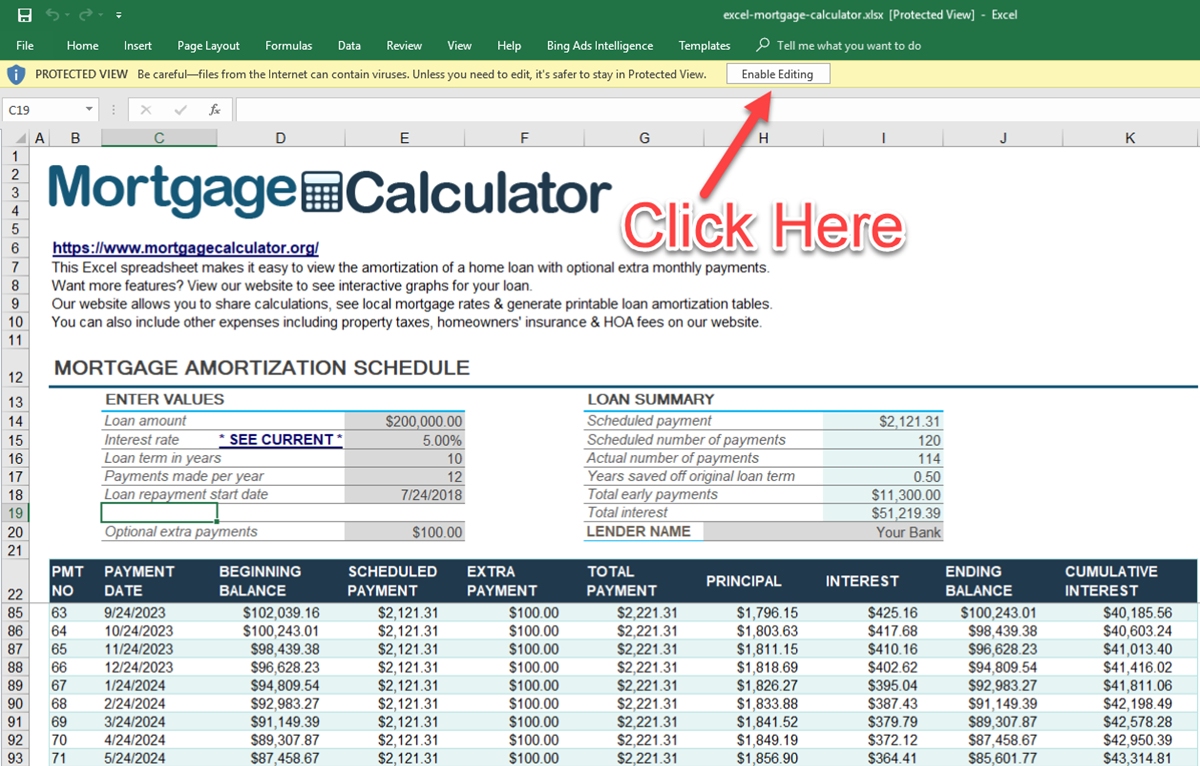

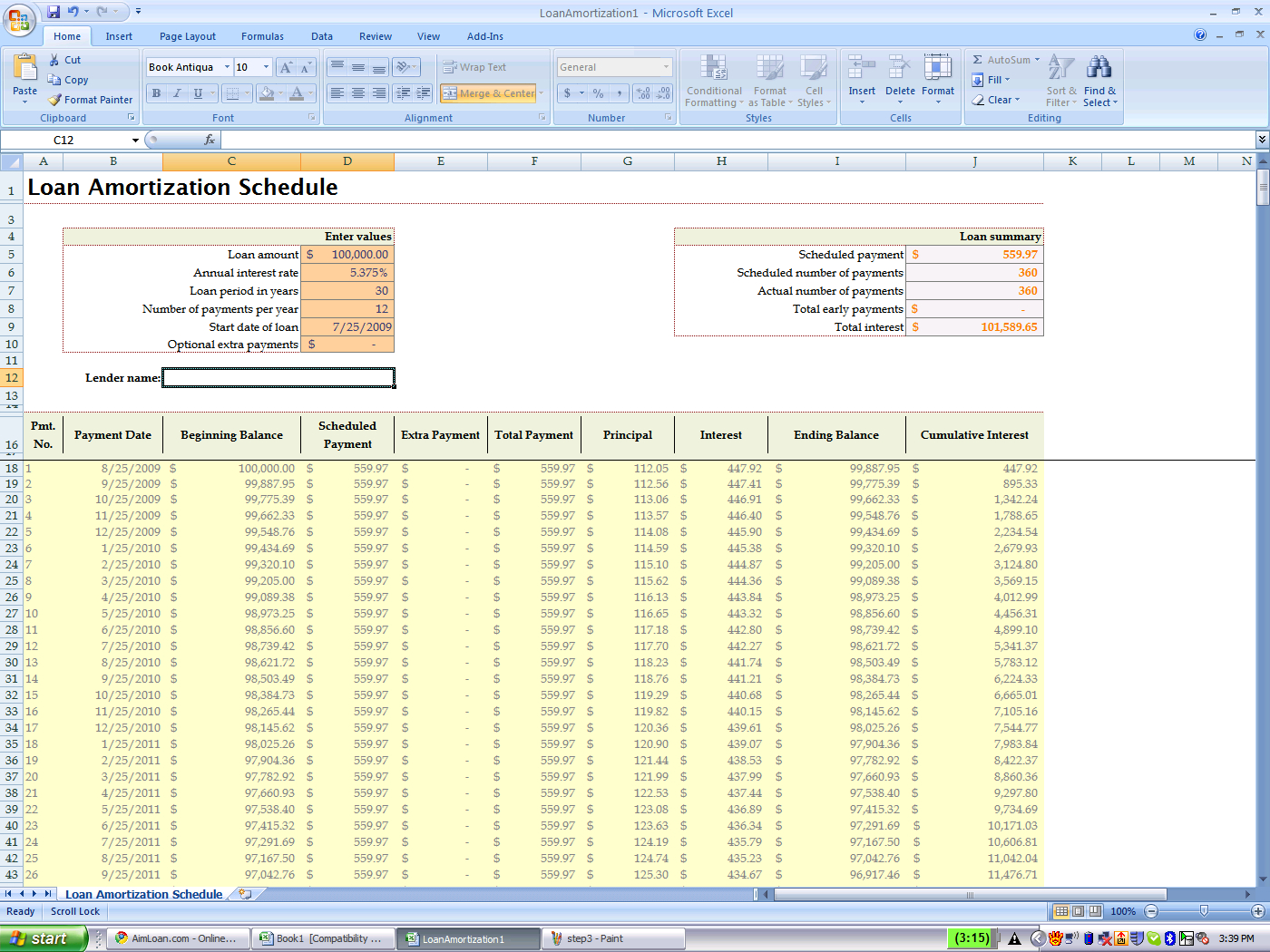

53K subscribers Subscribe 15K views 4 years ago Velocity Banking Training Series In this video, I'll show you how to use Mike's basic loan amortization & payoff calculator. You can download.

Velocity Banking Spreadsheet Template —

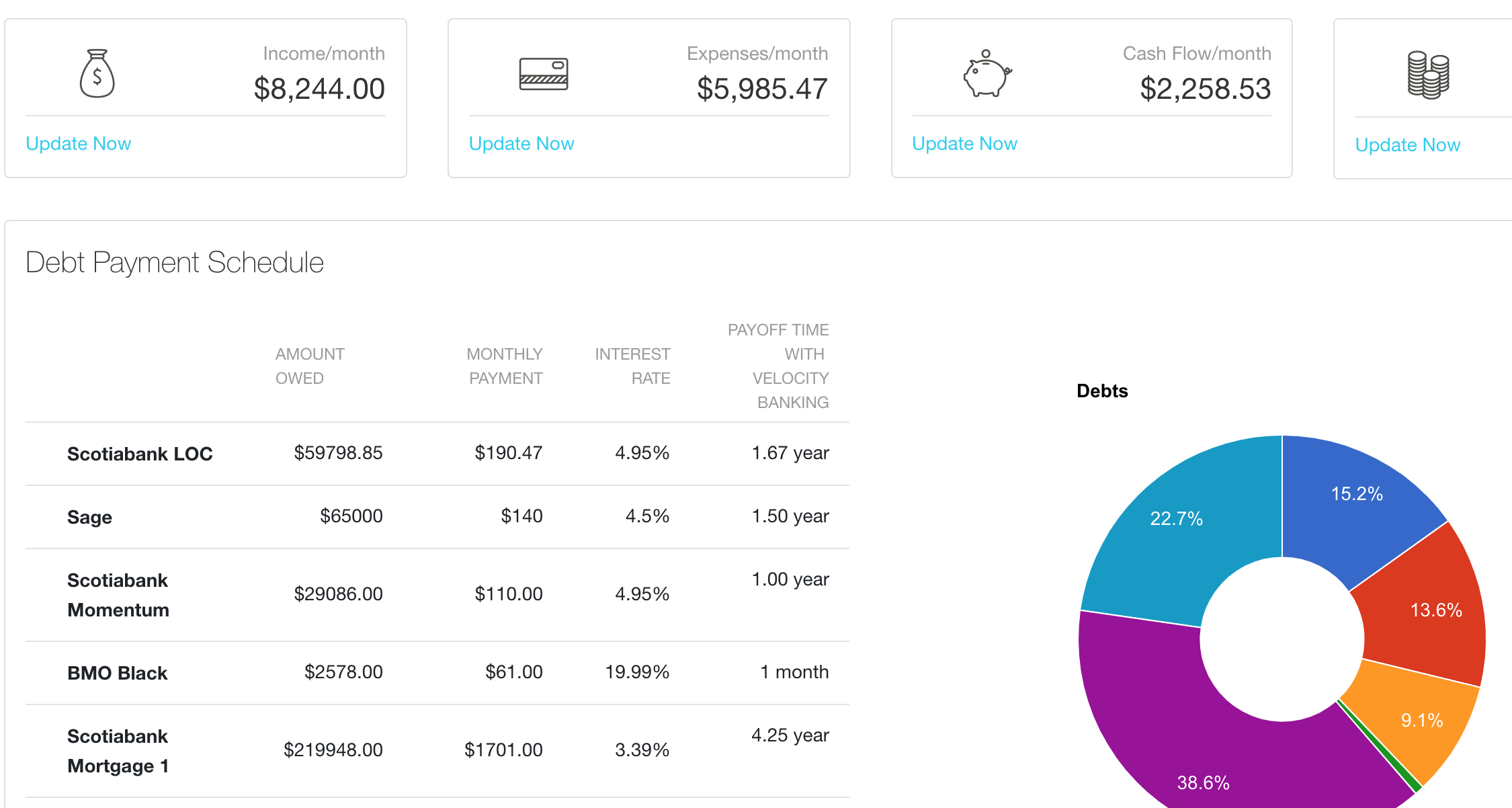

myVelocityBanking runs thousands of calculations to maximize your payments. Find the optimal split for credit card payments, car loans, student loans, and more. Pay-off schedule We show you what to pay and when. It's easy, accurate, and feels like magic. Step-by-step guidance Not sure where to begin? We've got you covered.

Velocity Banking Spreadsheet Template —

Table of Contents What is velocity banking? Velocity banking is a debt payoff method used to accelerate paying down a mortgage or other debts. This strategy typically utilizes a Home Equity Line of Credit (HELOC) to maximize net income and pay down your mortgage debt while minimizing interest costs.

Excel Spreadsheet For Velocity Banking Taylor Hicks

What is Velocity Banking? Velocity banking is a strategy that uses a Home Equity Line of Credit (HELOC) to pay off debts instead of the traditional way of paying from monthly income. Experts claim that velocity banking helps you reduce or pay off your debts faster and minimize the interest you pay. Velocity Banking vs. Infinite Banking

HELOC Calculator Walkthrough (Velocity Banking/Accelerated Banking

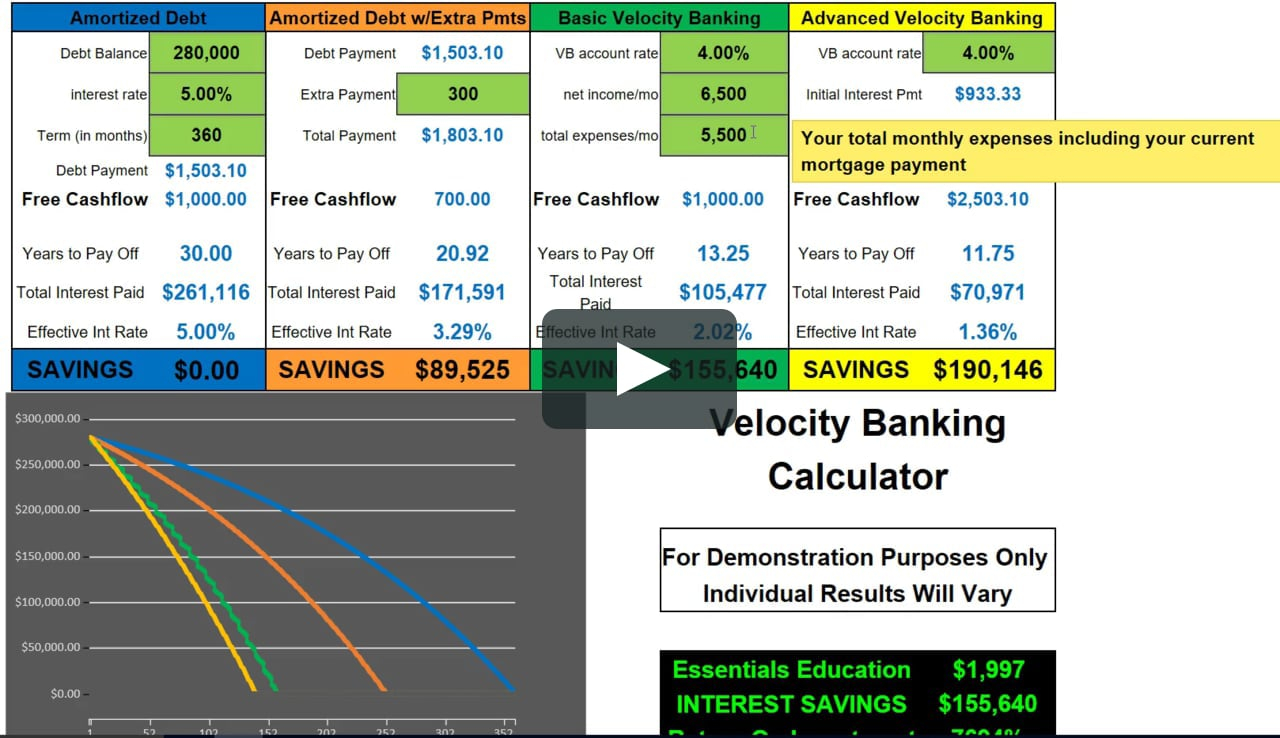

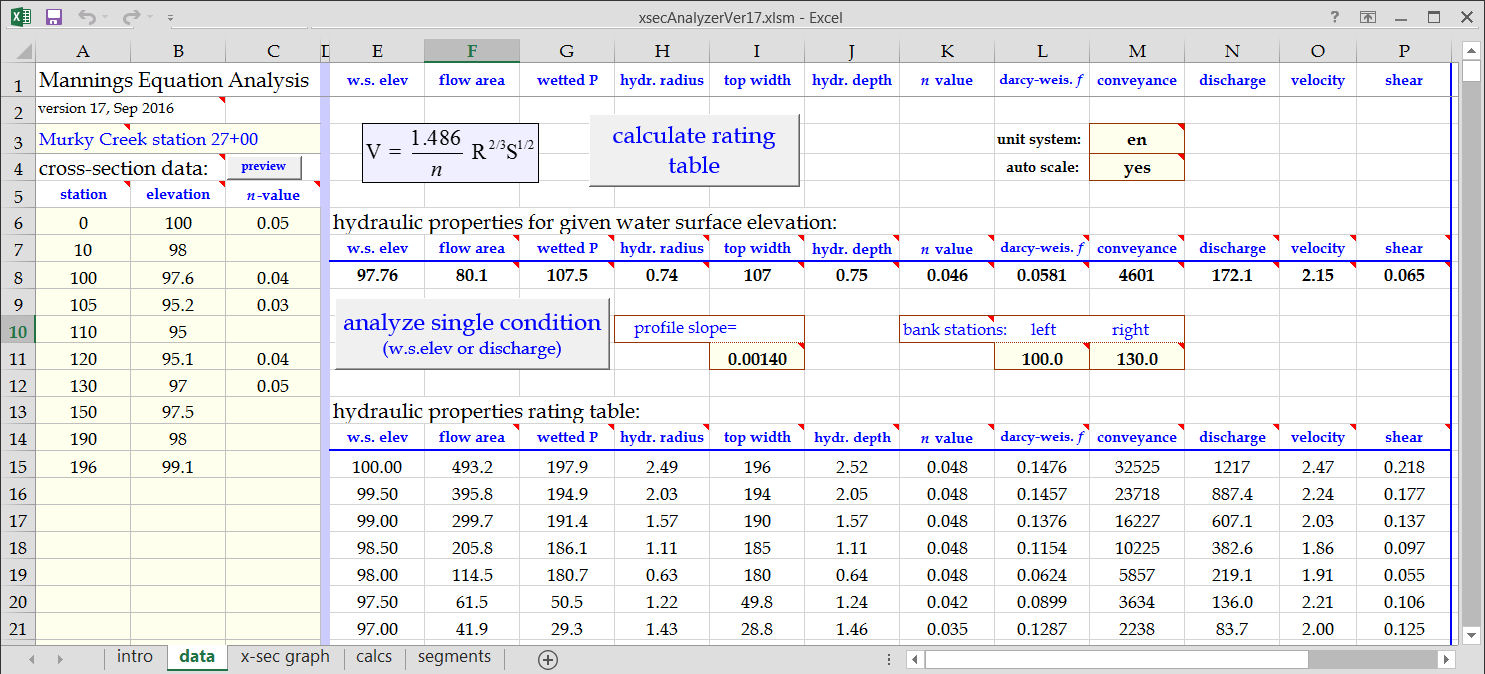

2. Jaded-Elephant-6249. • 3 mo. ago. So I found an Excel spreadsheet online used to calculate the Average Daily Balance (ADB) and compare different scenarios between a credit card to maximize interest savings. Pretty useful. I took it upon myself to modified and expand this spreadsheet into a Velocity Banking Calculator.

Velocity Banking Spreadsheet Template —

So what is velocity banking? Is the velocity banking strategy a good idea for your clients? And where's the numerical proof? Fortunately, the Truth Concepts calculators are primed to tell this story and give you the whole truth about velocity banking as any velocity banking calculator really should-no gimmicks, just numbers.

Velocity Banking Spreadsheet 1 Google Spreadshee velocity banking

Step 1: Create an Envelope Budgeting System. There are many different ways to budget. In my opinion, the envelope system is the most effective way to budget. You can purchase an envelope budgeting spreadsheet from my Shop, create your own spreadsheet, or find a budgeting app that works for you. Try to find ways to lower costs.

Velocity Banking & Calculating Expenses YouTube

This calculator helps you compare a velocity banking strategy rooted in whole life insurance, to the performance of other assets. This can help clients see how using whole life insurance for velocity banking can help them with their long-term financial strategy.

Velocity of Money Formula Calculator (Examples with Excel Template)

Discover the power of accelerated payments with the Velocity Banking Calculator. Use the chunking calculator to determine the years of payments you'll save.

Velocity Banking Explained How It Works + Should You Do It

How Velocity Banking Works Using the velocity banking strategy, you use your HELOC as your checking account. Once open the HELOC, draw almost the entire amount, leaving enough for emergencies if you don't have an emergency fund. Take the draw and put it toward your debt and monthly bills, including your mortgage.

VelocityBanking Free Online Debt Management

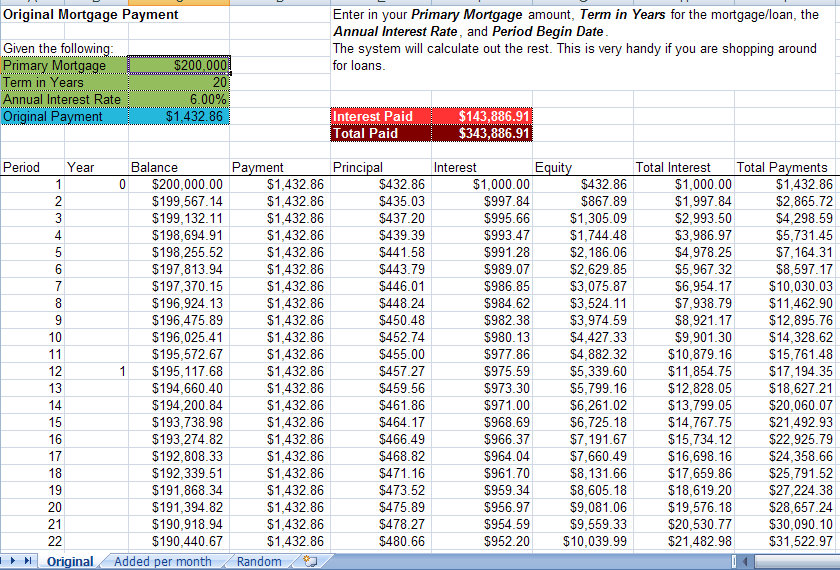

Velocity banking is a personal finance hack that can help you pay off your mortgage fast. We explain what it is and whether it's a good idea.. I used a calculator from the website Truth In Equity, entering these details: $200,000 mortgage balance. Appraised home value of $250,000.

A guide to velocity banking calculator

Velocity banking, also known as the HELOC strategy or mortgage acceleration strategy, is a financial technique that aims to help homeowners pay off their mortgage faster. It has gained popularity among individuals who want to become mortgage-free sooner and save thousands of dollars in interest payments.

velocity Bankingcalculator 2347482457 Banking, Velocity, Calculator

How velocity banking is supposed to work (and what could really happen) Step 1: Take out a mortgage. If you have a $300,000 mortgage with a 30-year payment term and a fixed 3% interest rate, you've agreed to pay your lender $1,265 each month for 360 months. That's adds up to a total of $155,000 in interest if you see the loan through.

VelocityBanking Free Online Debt Management

In this video, I will be covering my new velocity banking calculator. This is an online loan amortization calculator that you can use with the velocity banki.

Get My Calculator For Free Click The Link In The Description

The Velocity Banking Calculator support you find out how long it will take to save a particular amount of money with accelerated payments. Accelerated payments allow you to pay more on your mortgage early in exchange for lower monthly payments. When calculating acceleration, use our chunking calculator to determine the years saved.

Velocity banking Definition, Pros and Cons, Advantages Ascendant

If you owe $250,000 and your house is worth $320,000, you can qualify for a $59,000 HELOC at a low 3 or 4% interest rate. HELOC's typically have a draw period of 5 to 10 years and they behave like a regular checking account. You can easily move money in and out to pay your bills using your HELOC, or pay off your HELOC using your paycheck.